If you’ve received Restricted Stock Units (RSUs) as part of your compensation, understanding how they’re taxed is essential to avoid unexpected bills and plan effectively. This article is especially relevant to professionals in the following industries:

- Technology & Software

- Financial Services

- Healthcare & Pharmaceuticals

- Retail & Consumer Goods

- Energy & Utilities

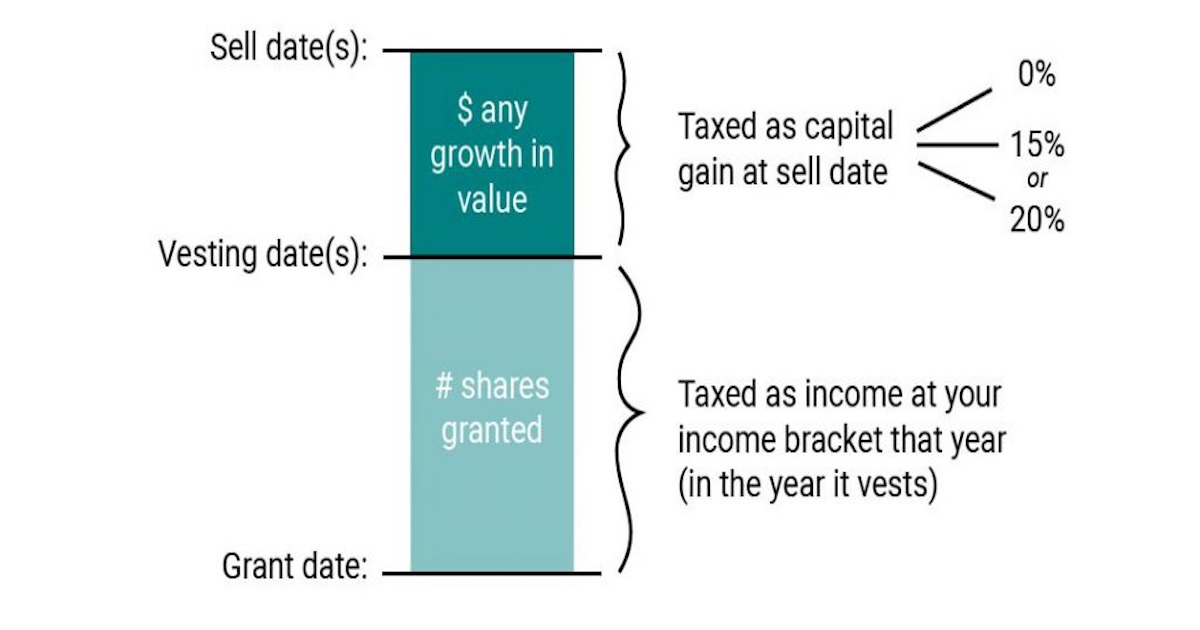

RSUs are taxed as ordinary income when they vest. The fair market value of the shares on the vesting date is included in your W-2 and subject to payroll tax withholding. If you later sell the shares for more than the value on the vesting date, the gain is taxed as a capital gain. These sales are reported on Form 1099-B, which may be accompanied by supplemental statements that detail your adjusted cost basis—essential for correctly reporting gains or losses on your tax return.

Key Questions to Ask Your Employer About RSU Taxation:

- What federal tax rate is used when my RSUs vest—22% flat rate or my actual tax bracket?

- Is RSU income factored into my W-4 tax withholding calculations?

- Can I adjust my W-4 to increase withholding during vesting months?

- Will payroll help estimate the extra withholding I should request?

- Where do I find RSU tax withholding details—pay stub or online portal?

Why Strategy Matters:

Without proper planning, RSU income can push you into a higher tax bracket, reduce eligibility for deductions or credits, or result in underpayment penalties. Strategic tax planning—including adjusting Form W-4 withholdings, planning sale timing, and forecasting income—can help you manage tax liabilities and avoid surprises.

Need help reviewing your RSU tax impact or planning ahead? Contact our office for customized support.

Key Takeaways:

- RSUs are taxed as ordinary income at vesting and reported on W-2.

- Shares sold above vesting value create capital gains, taxed separately.

- Form 1099-B reports share sales; supplemental statements may help with basis tracking.

- Accurate tax reporting requires reviewing all RSU-related documents.