-

RSU Tax Planning for Professionals with Equity Compensation

•

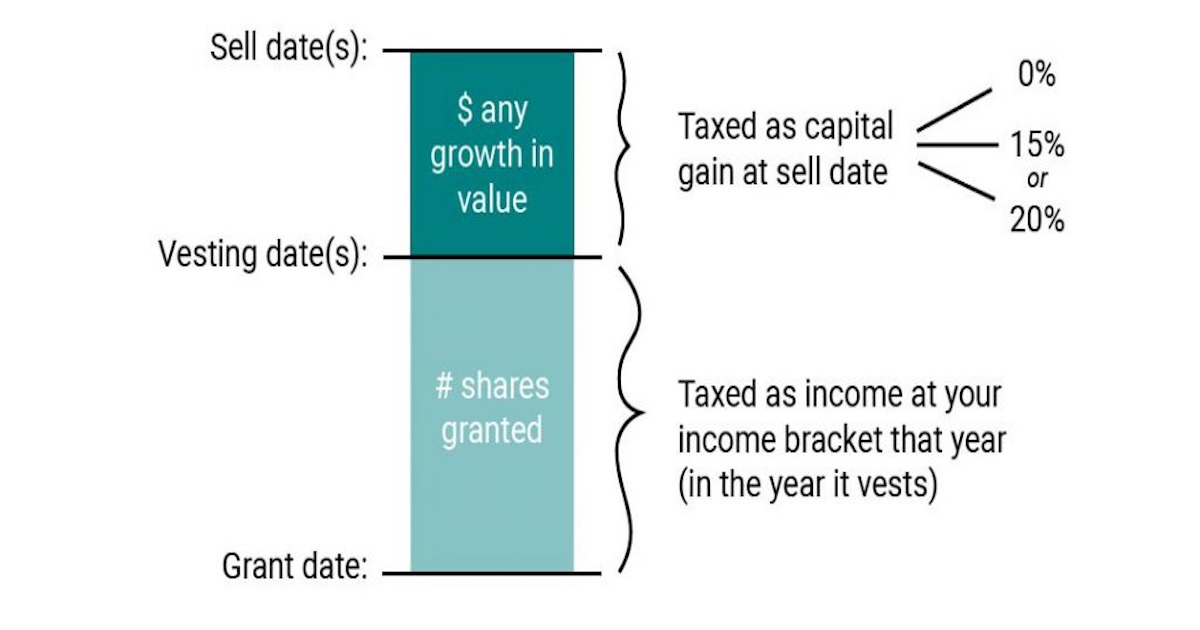

If you’ve received Restricted Stock Units (RSUs) as part of your compensation, understanding how they’re taxed is essential to avoid unexpected bills and plan effectively. This article is especially relevant to professionals in the following industries: RSUs are taxed as ordinary income when they vest. The fair market value of the shares on the vesting…

-

How Much Do Charitable Donations Reduce Income Tax?

•

If your expenses exceed the standard deduction and itemizing is more beneficial, you may wonder how donations affect your taxable income. Assuming an adjusted gross income (AGI) of $105,000, you can deduct cash contributions to qualified charities up to 60% of your AGI—approximately $63,000. Any contributions beyond this limit can be carried forward for up…