-

Do You Need to Charge Sales Tax on Services? Understanding What’s Taxable in Texas

•

In Texas, sales tax applies broadly to the sale of tangible personal property and to specific taxable services listed in the Texas Tax Code. In general, materials and products including sales of digital products are taxable in Texas, while labor charges for services—such as consulting, fitness training, nutrition and counseling, real estate agent commissions, or…

-

How to Avoid Surprise Tax Bills with the Premium Tax Credit

•

The premium tax credit (PTC) is designed to make health insurance affordable, but if your income is higher than expected or your life changes, you may have to repay part or all of that credit with you file your tax return.

-

Smart Strategies to Avoid IRS Penalties on Estimated Taxes

•

Avoiding CP30 Notices: A Guide to Estimated Tax Planning

-

Taxes Filed Late or Didn’t Pay? Expect IRS Penalties and Interest

•

If you haven’t filed yet and expect to owe, submit an extension ASAP to dodge the hefty late filing penalty.

-

S Corp Tax Savings Explained: What Every LLC Owner Should Know

•

If you operate a single-member LLC or multi-member LLC taxed as a partnership, you may be familiar with self-employment taxes eating into your bottom line. Electing S Corporation (S Corp) status can offer real tax savings….

-

You Always Owe? Fix that this Year…

•

Taxes can be a headache, but the IRS actually does give you a few tools to avoid overpaying—or worse, getting hit with a surprise bill. Remember your estimates aren’t set in stone. If your income or deductions shift mid-year, your payments can too. Check in periodically to make sure you’re not leaving savings on the table—or opening…

-

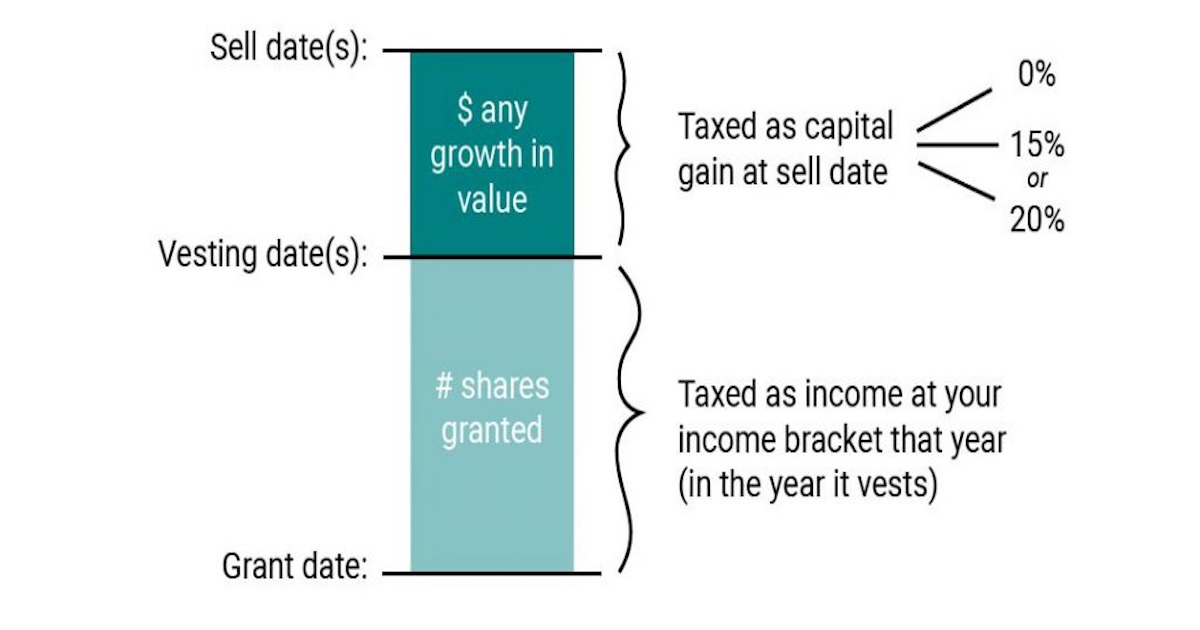

RSU Tax Planning for Professionals with Equity Compensation

•

If you’ve received Restricted Stock Units (RSUs) as part of your compensation, understanding how they’re taxed is essential to avoid unexpected bills and plan effectively. This article is especially relevant to professionals in the following industries: RSUs are taxed as ordinary income when they vest. The fair market value of the shares on the vesting…